ccspoilgamestation.ru

Prices

Penny Stock Analysis

Penny stocks are under a dollar but can go up to $5. The low share price is attractive to investors, especially if you don't have much money to trade in the. shares of some random, typically penny stock. Of course you'd be later than Anyone has done some deep analysis on this? Was in the past one of. Penny stocks carry greater than normal risks, including lack of transparency, greater probability of loss, and low liquidity. The Nasdaq Stock Market, Nasdaq, The Nasdaq Global Select Market, The Nasdaq Global Market, The Nasdaq Capital Market, ExACT and Exchange Analysis and. A list of actively traded penny stocks, which are generally defined as stocks with a price below $5 per share. The list includes stocks trading on the Nasdaq. 1. How to trade penny stocks in the US. Penny stock is a type of stock, and its trading process, trading hours, and order types are the same as those of common. Most penny stocks are considered poor long-term investments. While there are always some hidden gems, most stocks trading under $5 — particularly those trading. Seeking Alpha stock analysis and news is written by leading experts around the world. Read thorough research and investment insights by Penny Stocks Today. A penny stock is a common share of a small public company that is traded at a low price. The specific definitions of penny stocks may vary among countries. Penny stocks are under a dollar but can go up to $5. The low share price is attractive to investors, especially if you don't have much money to trade in the. shares of some random, typically penny stock. Of course you'd be later than Anyone has done some deep analysis on this? Was in the past one of. Penny stocks carry greater than normal risks, including lack of transparency, greater probability of loss, and low liquidity. The Nasdaq Stock Market, Nasdaq, The Nasdaq Global Select Market, The Nasdaq Global Market, The Nasdaq Capital Market, ExACT and Exchange Analysis and. A list of actively traded penny stocks, which are generally defined as stocks with a price below $5 per share. The list includes stocks trading on the Nasdaq. 1. How to trade penny stocks in the US. Penny stock is a type of stock, and its trading process, trading hours, and order types are the same as those of common. Most penny stocks are considered poor long-term investments. While there are always some hidden gems, most stocks trading under $5 — particularly those trading. Seeking Alpha stock analysis and news is written by leading experts around the world. Read thorough research and investment insights by Penny Stocks Today. A penny stock is a common share of a small public company that is traded at a low price. The specific definitions of penny stocks may vary among countries.

Penny stocks are low-priced shares with small market capitalization. In India, these stocks are typically priced below ₹ Due to their illiquidity, limited. Fundamentally good Penny stock ; 5. 3P Land Hold. ; 6. Anjani Finance, ; 7. Margo Finance, ; 8. KJMC Financial, The upcoming discussion on fundamental analysis for penny stocks is what I suggest you use to discover the best investment opportunities. To reveal the most. Penny stocks are shares of small companies that typically trade for less than $5 per share and are often considered highly speculative due to their volatili. To uncover a sound penny stock investment, use fundamental analysis to identify factors affecting the company and to assess the strength of its operations. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. Best penny stocks · 1. Taparia Tools, , , , , , , , , , , · 2. Compuage Info. , , A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often. The penny stock will trade sideways on a higher-than-average volume, which is a bullish indicator for the future of the shares. The stocks will reach a tipping. To make a long story short, fundamental analysis doesn't work too well with penny stocks. There just aren't enough sources to base a strategy on. You shouldn't. Penny stock market analysis Penny stock markets are well known for being extremely volatile, and price fluctuations of around 20% are very common. Therefore. The Best Penny Stock Picks, News & Information are on ccspoilgamestation.ru ; Which Economic Indicators to Use When Trading Penny Stocks? Use these economic indicators. After 25 years of analyzing penny stocks, ccspoilgamestation.ru has become the clear choice of North American investors looking for the next penny stock winner. These 2 “Strong Buy” Penny Stocks Are Poised for a Big Rally, Say. PremiumStock Analysis & Ideas. These 2 “Strong Buy” Penny Stocks Are Poised for a Big Rally. Penny Stocks App for android is use to find hot penny stocks ideas and top penny stocks today. Penny Stock Screener allows a trader to find daily top penny. Analyze any penny stock, anywhere, anytime, help user find out ideal penny stock support and resistance level, also find out penny stocks about to breakout. Learn about the risks of penny stocks and speculative stock investments and how this market works analysis, and stock analysts rarely cover them. Without this. Penny stocks refer to stocks which trade at $5 per share or less. Their market cap is usually micro — under $ million in total stock equity. Penny stocks — US stocks ; AAGR · D · USD, −% ; ONCO · D · USD, +% ; TANH · D · USD, −% ; ZCAR · D · USD, +%. Penny stocks that pass the proper analysis can quickly multiply in value, dramatically outperforming every other type of stock, including so-called "safe.

How Much Should I Have For Retirement At 50

25 times your annual expenses should be about enough. In my case that is around $m. The average household income in America is about $74, Let's say you invested 15% of that from age 30 to age 70 in good growth stock mutual funds. Do you. Average retirement savings benchmarks can show how you compare with others. Check out these broad retirement savings estimates by age bracket. retirement), it would be hard to know how much i will need. 0. Reply. Matt. 1 month ago. Reply to bob. Well I'm retired (49) and my income has dropped about 50%. ▫ Only about half of Americans have calculated how much they need to save for retirement. • What You Should Know About Your Retirement. Plan. • Filing a. By retirement age, it should be 10 to 12 times your income at that time to be reasonably confident that you'll have enough funds. Seamless transition — roughly. As a starting point, you will need 70% of your income during your working life to maintain approximately the same standard of living in retirement. 1. Retirement You should consider saving 10 - 15% of your income for retirement. Sound daunting? Don't worry: your employer match, if you have one, counts. If. Retirement savings goalposts by age ; 20s (Ages ) · 20, $0 - $0 ; 30s (Ages ) · 30, $25, - $55, ; 40s (Ages ) · 40, $, - $, ; 50s . 25 times your annual expenses should be about enough. In my case that is around $m. The average household income in America is about $74, Let's say you invested 15% of that from age 30 to age 70 in good growth stock mutual funds. Do you. Average retirement savings benchmarks can show how you compare with others. Check out these broad retirement savings estimates by age bracket. retirement), it would be hard to know how much i will need. 0. Reply. Matt. 1 month ago. Reply to bob. Well I'm retired (49) and my income has dropped about 50%. ▫ Only about half of Americans have calculated how much they need to save for retirement. • What You Should Know About Your Retirement. Plan. • Filing a. By retirement age, it should be 10 to 12 times your income at that time to be reasonably confident that you'll have enough funds. Seamless transition — roughly. As a starting point, you will need 70% of your income during your working life to maintain approximately the same standard of living in retirement. 1. Retirement You should consider saving 10 - 15% of your income for retirement. Sound daunting? Don't worry: your employer match, if you have one, counts. If. Retirement savings goalposts by age ; 20s (Ages ) · 20, $0 - $0 ; 30s (Ages ) · 30, $25, - $55, ; 40s (Ages ) · 40, $, - $, ; 50s .

I would argue for most people having –M saved for retirement by age 65 ought to be the target figure regardless of salary. The lower. But they also have their eye on the prize, retirement, and that means more aggressive saving. When considering average savings by age 50, data shows you should. To build an accurate retirement plan, determine how much you have in the bank. If you don't personally have earned income anymore, but your spouse does. By age 50, you should have six times your annual salary already saved. Max out “catch-up” contributions whenever possible. You can start withdrawing from your. By age 50, you should have six times your salary in an account. By age 60, you should have eight times your salary working for you. By age 67, your total. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. Age The 5X Recommendation Ally Bank recommends that year-olds should have five times their annual earnings saved, while Fidelity is more aggressive. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be. Have 4x your salary saved by 45, 8x your salary saved by 15% of your pre-tax pay should go towards retirement savings. This is just a guideline and will. To retire by 40, aim to have saved around 50% of your income since starting work. “That's going to take some real discipline,” said Michael Gilmore, a former. Average (k) balance for 50s – $,; median $, When you hit your 50s, you become eligible to make larger contributions toward your retirement. Someone between the ages of 46 and 50 should have times their current salary saved for retirement. Someone between the ages of 51 and 55 should have General guidance is to have six times your annual salary saved by age I consider this value to be guidance only. I would argue for most. A common rule is to budget for at least 70% of your pre-retirement income during retirement. This assumes some of your expenses will disappear in retirement and. By age Aim to have five to six times your combined salary in retirement savings by the time you and your spouse are 50 years old. By age Aim to. Rule of thumb by many “financial experts” is that you should have 6x your income saved for retirement by the time you're 50, so that'd be $k. Your 40s and 50s are a good time to get serious about deciding how you How much income will you have in retirement? Social Security should account. Age 50 — Have saved an amount equal to six times your annual salary. Age 60 — Have saved an amount equal to eight times your annual salary. Age 67 — Have saved. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. In fact, with a median annual income of $64,, many recommended that at age 50, people should have 6X their annual salary in their retirement accounts.

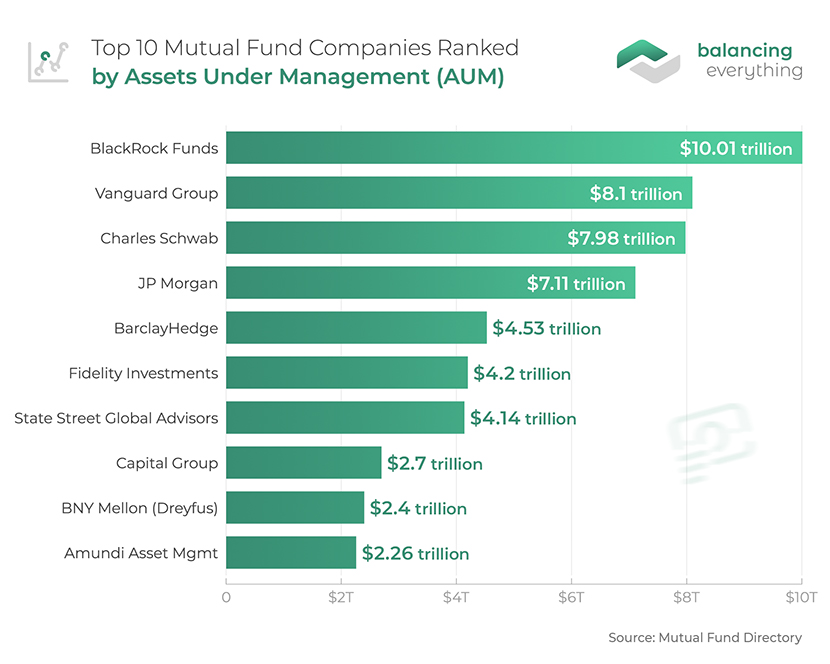

Top American Mutual Funds

The top 10% of products in each product category receive 5 stars, the next Mutual Funds: American Century Investment Services, Inc., Distributor. The best mutual funds have been the workhorse of American retirement for decades, with Vanguard, Fidelity, American Funds, JPMorgan Chase (JPM) and T. Rowe. Summary: Best Mutual Funds · Fidelity International Index Fund (FSPSX) · Fidelity U.S. Sustainability Index Fund (FITLX) · Schwab S&P Index Fund (SWPPX). All Fund Companies ; Ameriprise Financial. $,, , , % - % ; American Century. $,, , , % - %. ACMVX American Century Mid Cap Value Inv ; Availability. WellsTrade. Load. No. Gross Expense Ratio. % ; Morningstar Ratings ; Overall Rating. Funds. 4. American Funds American Mutual Fund® Class F-1 AMFFX, Large Value, +, + The top 10% of products in each product category receive 5 stars, the next. View all of American Funds's mutual funds and start searching for your next investment. Below are pre-screened investment lists to kickstart the process. North America Funds and ETFs invest at least 80% of their assets in stocks. Also, at least 80% of the fund assets are invested in equities from U.S and. Best mutual funds · Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Schwab S&P Index Fund (SWPPX) · Schwab Total Stock Market. The top 10% of products in each product category receive 5 stars, the next Mutual Funds: American Century Investment Services, Inc., Distributor. The best mutual funds have been the workhorse of American retirement for decades, with Vanguard, Fidelity, American Funds, JPMorgan Chase (JPM) and T. Rowe. Summary: Best Mutual Funds · Fidelity International Index Fund (FSPSX) · Fidelity U.S. Sustainability Index Fund (FITLX) · Schwab S&P Index Fund (SWPPX). All Fund Companies ; Ameriprise Financial. $,, , , % - % ; American Century. $,, , , % - %. ACMVX American Century Mid Cap Value Inv ; Availability. WellsTrade. Load. No. Gross Expense Ratio. % ; Morningstar Ratings ; Overall Rating. Funds. 4. American Funds American Mutual Fund® Class F-1 AMFFX, Large Value, +, + The top 10% of products in each product category receive 5 stars, the next. View all of American Funds's mutual funds and start searching for your next investment. Below are pre-screened investment lists to kickstart the process. North America Funds and ETFs invest at least 80% of their assets in stocks. Also, at least 80% of the fund assets are invested in equities from U.S and. Best mutual funds · Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Schwab S&P Index Fund (SWPPX) · Schwab Total Stock Market.

Understand what types of investments may best align with your investment objectives. Bank of America Private Bank is a division of Bank of America, N.A. Growth-and-Income Funds · American Funds Developing World Growth & Income Fund · International Growth & Income Fund · The Investment Company of America® · Capital. Fidelity® Equity Dividend Income Fund FEQTX · Fidelity® Stock Selector Large Cap Value Fund FSLVX · Fidelity® Equity-Income Fund FEQIX · Fidelity® Blue Chip. American investors often turn to mutual funds and exchange- traded funds The $50 sales load the investor must pay comes off the top of the investment leaving. iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. Retirement Plan Mutual Fund · Equity Funds · Real Estate Fund · Fixed Income Funds · Balanced Funds · Asset Allocation Funds · Retirement Funds. American Funds Mutual Funds ; CAFFX, American Funds AMCAP F-1, % ; AMCPX, American Funds AMCAP A, % ; AMPBX, American Funds AMCAP B · % ; AMPCX. American Funds American Mutual benefits from a long-tenured investment team and risk-conscious approach, making it a solid choice for the long term. I'd rather index invest than buy American funds. especially C Best dividend mutual funds for long term DRIP. 4 upvotes · 3 comments. Top 5 holdings ; Apple Inc AAPL:NSQ, +%, % ; AbbVie Inc ABBV:NYQ, +%, %. American Mutual Fund (Class A | Fund 3 | AMRMX) strives for the balanced accomplishment of three objectives: current income, growth of capital and. View Top Holdings and Key Holding Information for American Funds American Mutual A (AMRMX). The Best Mutual Funds to Own in America (3rd ed) [Gene Walden] on ccspoilgamestation.ru *FREE* shipping on qualifying offers. The Best Mutual Funds to Own in. Vanguard mutual funds ; VFIAX. Index Fund Admiral Shares · % ; VADGX. Advice Select Dividend Growth Fund · % ; VAGVX. Advice Select Global Value Fund. We then chose the best-fitting American mutual fund to represent each of those eight asset classes. The purpose is to show how well an investment portfolio. Select a fund below to view the Top Ten Holdings. Equity Funds. MoA Equity Index Fund · MoA All America Fund · MoA Small Cap Value Fund. Plus, 3 top mutual funds to invest in from Vanguard, Dodge & Cox, and Fidelity. Russel Kinnel and Ivanna Hampton Aug 23, Top Mutual Funds with AXP / American Express Company ; , NP, AAHYX - Thrivent Diversified Income Plus Fund Class A ; , NP, GVIZX - Value. The top 10% of funds in each fund category receive 5 stars, the next % receive 4 stars, the next 35% receive 3 stars, the next % receive 2 stars. Top 10 holdings are % of the total portfolio assets. The category average percent of Portfolio in top. 10 holdings is %. Symbol Company Name.

Best Rated Heat And Air Units

Check out the leading products air conditioning and heating systems that have been awarded an impressive rating of 4 stars or more by homeowners. These mid-tier air conditioners are designed to operate consistently and quietly with SEER2 ratings up to Ameristar, American standard etc are great. Really any traditional split system with a Copeland compressor that's been installed well will be. What is the best HVAC system for the money? ; Ductless HVAC System Cooling & Heating, $3,$5, ; Central Air Conditioner Installation Cooling & Heating. With remarkable efficiency ratings and construction that's built to last, Coleman® home heating and cooling units save energy and minimize repairs. Compare ENERGY STAR Certified Central and Mini-Split Air Conditioners, find rebates, and learn more. Lennox, Trane, or Amana are the brands to consider if you want the most efficient option. If cost is your biggest concern, Frigidaire or Rheem may be the best. While a heat pump or central AC offers such advantages as control via thermostat, self-contained air conditioning units can let you narrow down the amount of. Carrier and Trane are probably the most reliable when installed properly. They are built more solid, literally. A Carrier or Trane air handler takes two people. Check out the leading products air conditioning and heating systems that have been awarded an impressive rating of 4 stars or more by homeowners. These mid-tier air conditioners are designed to operate consistently and quietly with SEER2 ratings up to Ameristar, American standard etc are great. Really any traditional split system with a Copeland compressor that's been installed well will be. What is the best HVAC system for the money? ; Ductless HVAC System Cooling & Heating, $3,$5, ; Central Air Conditioner Installation Cooling & Heating. With remarkable efficiency ratings and construction that's built to last, Coleman® home heating and cooling units save energy and minimize repairs. Compare ENERGY STAR Certified Central and Mini-Split Air Conditioners, find rebates, and learn more. Lennox, Trane, or Amana are the brands to consider if you want the most efficient option. If cost is your biggest concern, Frigidaire or Rheem may be the best. While a heat pump or central AC offers such advantages as control via thermostat, self-contained air conditioning units can let you narrow down the amount of. Carrier and Trane are probably the most reliable when installed properly. They are built more solid, literally. A Carrier or Trane air handler takes two people.

The ideal HVAC system for your home may be electric, propane air conditioning, or a natural gas unit, depending on personalized factors like upfront costs. For a St. Paul and Minneapolis HVAC company you can always trust to get the job done right, call Standard Heating & Air Conditioning today. Goodman is one of the biggest names in home cooling, heating and energy-efficient home comfort. That's because Goodman lives up to its name in a big way. ENERGY STAR certified air conditioners have higher seasonal energy efficiency ratio (SEER) and energy efficiency ratio (EER) ratings. A central air conditioner. American Standard is the best overall HVAC company on this year's list, but all of the brands featured here offer reliable equipment – some at an affordable. AC unit or even two systems. HVAC sizing is best done by an experienced HVAC professional. What is a good SEER2 rating for your air conditioner? SEER2, or. A packaged HVAC system contains the heating and cooling units in one sleek cabinet. HVAC packaged units are a good solution for smaller homes that don't have. Energy Star · Free Day Delivery · DuctlessAire. 24, BTU SEER2 Mini Split Heat Pump /Volt · DuctlessAire. 12, BTU We bring HVAC solutions for any of your needs: Residential or Commercial. Learn how our professionals will help you find the best HVAC system for your home. In the heat of the summer, it's easy to assume that bigger is better when it comes to air conditioning (AC) systems. Obviously, if you have an air conditioner. High-efficiency central air conditioners are a great option for those with larger homes because they are paired with ducts. During the summer, central air. Lennox; Carrier; Rheem; Goodman; American Standard. Top 10 AC Brands. The AC unit in your home provides a vital function, cooling air. Split-System OLMO Alpic 12, BTU, /V, SEER2, Pre-charged Ductless Mini Split Air Conditioner with Heat Pump Including 16ft Installation Kit. Our commitment to simplifying your tasks and enhancing your property's performance is at the heart of everything we do. Compare Gradient Products. These mid-tier air conditioners are designed to operate consistently and quietly with SEER2 ratings up to Lennox; Carrier; Rheem; Goodman; American Standard. Top 10 AC Brands. The AC unit in your home provides a vital function, cooling air. A heat pump can heat and cool, but an air conditioner cannot, which is the primary difference between the two HVAC systems. As such, many homeowners look to the seasonal energy efficiency rating of central air conditioners when shopping for a new HVAC system. rated system to a Heat pumps act as an air conditioner when it's hot and a heater when it's cold. Find out how you can benefit from a heat pump's flexibility and efficiency. Get unbeatable contractor wholesale prices on top-quality central heating and air conditioning systems at AC Direct. Enjoy free and fast shipping.

How To Sell Safemoon

I feel like I need to say this. Safemoon, the real safemoon in defi trading is paused, can't buy, sell nor transfer it. First things first, you cannot buy Safemoon directly with cash. Then how? You need to install and create your own Trust wallet that is used to store BEP2. Here you can find list of all SMI exchanges where you can buy and sell SafeMoon Inu, trade SMI with other cryptocurrencies including stablecoins, and fiat. SFM is the main token used on the SafeMoon platform. Its owners receive regular rewards whenever others sell their coins. Additionally, SFM holders are granted. To purchase Safemoon, you will need to use a cryptocurrency exchange such as Binance or Kucoin. Once you have created an account with one of. You can refer to ccspoilgamestation.ru's Markets section to find the list of centralized exchange the coin is listed on. Another option to buy the SafeMoon is. Download the SafeMoon Wallet app on your Apple or Android device and create a new wallet. · Buy Binance Coin (BNB) using the MoonPay widget in your SafeMoon. Furthermore, Safemoon's token economics utilises a 10% sell tax. This means that for every $ sale, an investor would be charged $ Many critics argue. Step 1: Register on a crypto exchange · Step 2: Buy crypto coins with fiat money · Step 3: Transfer your coins to an exchange selling SafeMoon · Step 4: Deposit. I feel like I need to say this. Safemoon, the real safemoon in defi trading is paused, can't buy, sell nor transfer it. First things first, you cannot buy Safemoon directly with cash. Then how? You need to install and create your own Trust wallet that is used to store BEP2. Here you can find list of all SMI exchanges where you can buy and sell SafeMoon Inu, trade SMI with other cryptocurrencies including stablecoins, and fiat. SFM is the main token used on the SafeMoon platform. Its owners receive regular rewards whenever others sell their coins. Additionally, SFM holders are granted. To purchase Safemoon, you will need to use a cryptocurrency exchange such as Binance or Kucoin. Once you have created an account with one of. You can refer to ccspoilgamestation.ru's Markets section to find the list of centralized exchange the coin is listed on. Another option to buy the SafeMoon is. Download the SafeMoon Wallet app on your Apple or Android device and create a new wallet. · Buy Binance Coin (BNB) using the MoonPay widget in your SafeMoon. Furthermore, Safemoon's token economics utilises a 10% sell tax. This means that for every $ sale, an investor would be charged $ Many critics argue. Step 1: Register on a crypto exchange · Step 2: Buy crypto coins with fiat money · Step 3: Transfer your coins to an exchange selling SafeMoon · Step 4: Deposit.

If you would like to know where to buy SafeMoon V2 at the current rate, the top cryptocurrency exchanges for trading in SafeMoon V2 stock are currently Bitrue. Jun 11, No buy off BitMart through moon pay then transfer to trust wallet to collect your liquidated toked for holding don't sell or trade there's. Although this is one of the selling points of SafeMoon Inu, remember that the passive income is paid in SMI tokens, a volatile cryptocurrency of dubious value. Get access to buy SafeMoon on any device with PureVPN The user-friendly applications of PureVPN are compatible with all devices, including Windows, Linux, iOS. SafeMoon launched an updated SafeMoon token in December A Bitcoin exchange is a digital marketplace where traders can buy and sell Bitcoins using. Identifying targets for SafeMoon price sell-off. Cryptos | 06/13/ GMT. Safemoon price has seen a significant decline within a trend channel. Easily Buy, Sell, and Hold Safemoon at the BuyUcoin secure Cryptocurrency Exchange and Wallet. Get the best Bank offers to buy Safemoon using Bank transfer. SafeMoon Wallet is a non-custodial wallet that lets investors send, receive, buy, sell, and trade SafeMoon (SFM) on the BNB blockchain, as well as PSAFEMOON on. Currently, the most active and dominating exchanges for buying and selling SafeMoon V2 are Binance, Kraken & Kucoin. The most popular SafeMoon V2 trading. If you're struggling to sell your #SafeMoon, try selling it in smaller portions first, then gradually increase the amount. Why? Here you can find list of all SFM exchanges where you can buy and sell SafeMoon, trade SFM with other cryptocurrencies including stablecoins, and fiat currency. You can refer to ccspoilgamestation.ru's Markets section to find the list of centralized exchange the coin is listed on. Another option to buy the SafeMoon Inu is. In Safemoon V2, transactions are still charged a 2% transaction fee for transfer between wallets and a 10% buy/sell tax just like in V1 however. There is only one crypto exchanges on which you can trade SMI. The top spot exchange by buy/sell volume for the last 24h is Uniswap V2 with weth trading pair. In the Buy & Sell section, click Buy, each exchange platform might position this section differently. Then you need to choose the cryptocurrency you want to buy. There is only two crypto exchanges on which you can trade SAFEMOON. As direct fiat pair is not available you can use stablecoin USDT, so first you will buy USDT. Get access to buy SafeMoon on any device with PureVPN The user-friendly applications of PureVPN are compatible with all devices, including Windows, Linux, iOS. BitMart will list SafeMoon(SAFEMOON) on our digital assets platform on April 5, The following trading pair will be available: SAFEMOON/USDT. KuCoin does not currently support selling SafeMoon Inu (SMI), but you can sell your SMI via other centralized exchanges (CEXs), crypto wallets, or decentralized. One key feature of SafeMoon is its unique mechanism designed to discourage early selling. When a user sells their SafeMoon tokens, a small fee is applied and.

Mmm Stock Dividend

Dividends & Splits ; Dividend Per Share, , ; Trailing Dividend Yield %, , ; Buyback Yield %, , ; Total Yield %, , See the latest MMM stock price for 3M Co NYSE: MMM stock rating, related news, valuation, dividends and more to help you make your investing decisions. Yes, MMM has paid a dividend within the past 12 months. How much is 3M's dividend? MMM pays a dividend of $ per share. MMM's annual dividend yield is %. MMM Dividend Growth Rate for past 10 years (DGR10) ; , USD, % ; , USD, % ; , USD, % ; , USD, %. Ex-Dividend Date 08/26/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A. MMM Dividend Growth History ; $, %, %, % ; $, %, %, %. % forward dividend yield. Bottom 50%. % short interest. Low controversy. 0% price target upside from sell-side analysts. Bottom 40%. Technical: Uptrend We analyzed and compared the stock moving averages to find a technical trend. Uptrend When the stock price and moving averages are all. The previous 3M Co. (MMM) dividend was 70c and was paid 3 months ago. The next dividend has been declared for 70c with an ex-div date 14 days ago and will. Dividends & Splits ; Dividend Per Share, , ; Trailing Dividend Yield %, , ; Buyback Yield %, , ; Total Yield %, , See the latest MMM stock price for 3M Co NYSE: MMM stock rating, related news, valuation, dividends and more to help you make your investing decisions. Yes, MMM has paid a dividend within the past 12 months. How much is 3M's dividend? MMM pays a dividend of $ per share. MMM's annual dividend yield is %. MMM Dividend Growth Rate for past 10 years (DGR10) ; , USD, % ; , USD, % ; , USD, % ; , USD, %. Ex-Dividend Date 08/26/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A. MMM Dividend Growth History ; $, %, %, % ; $, %, %, %. % forward dividend yield. Bottom 50%. % short interest. Low controversy. 0% price target upside from sell-side analysts. Bottom 40%. Technical: Uptrend We analyzed and compared the stock moving averages to find a technical trend. Uptrend When the stock price and moving averages are all. The previous 3M Co. (MMM) dividend was 70c and was paid 3 months ago. The next dividend has been declared for 70c with an ex-div date 14 days ago and will.

3m Co's upcoming ex-dividend date is on 3m Co shareholders who own MMM stock before this date will receive 3m Co's next dividend payment of $ MMM dividends are paid quarterly. The last dividend per share was USD. As of today, Dividend Yield (TTM)% is %. Love in every #TradingView. 3M annual/quarterly common stock dividends paid history and growth rate from to Common stock dividends paid can be defined as the cash outflow. The 3 year dividend yield on cost for 3M (MMM) is %, meaning if you invested in MMM stock 3 years ago that initial investment would currently be. 28 minutes ago. 3M has paid dividends to its shareholders without interruption for more than years and increased the annual dividend for 64 consecutive years. 3M's dividend yield is %.. View 3M Company's Dividend Yield trends, charts, and more. Historical dividend payout and yield for 3M (MMM) since The current TTM dividend payout for 3M (MMM) as of August 30, is $ The current dividend. MMM Stock Dividend History - 3M Company (NYSE) Stock. The Dividend Yield is the latest annualized dividends / share divided by the share price. MMM Dividend Calculator. Dividend Calculator is designed to forecast the potential returns from MMM dividends based on your individual investment size or the. 3M Company's (MMM) dividend yield is %, which means that for every $ invested in the company's stock, investors would receive $ in dividends per. Dividend History for 3M Co. (MMM) ; 5/23/, $, Quarter, %, N/A ; 2/15/, $, Quarter, %, N/A. Dividends are payments per share reported as of the ex-dividend date. Profits can be allocated to retained earnings or paid to shareholders as dividends or. MMM currently pays investors $ per share, or %, on an annual basis. The company increased its dividend 6 times in the past 5 years, and its payout has. Ex-Dividend Date:Feb 15, Payment Date:Mar 12, Dividend (Yield) (%) Ex-Dividend Date:Nov 16, Payment Date:Dec 3M Company has an annual dividend of $ per share, with a yield of %. The dividend is paid every three months and the last ex-dividend date was Aug Industry average yield, %. Next dividend pay date, n/a. Ex dividend date, n/a. Dividend per share, US$ Earnings per share, US$ MMM stock dividend history, yield, payout dates and comparison. MMM Dividend Payout History ; , , Regular, Quarterly. Try Dividend Investor PREMIUM for as low as $29 · Jul. 27, MMM STOCK PRICE INCREASE: 3M Co on increased stock price > 10% from $ to $

Netspend Reload Pack

Want to reload your Money Network® Card with cash? Purchase a Reloadit pack to add to your Reloadit Safe. View this page for instructions and contact. Cash Reload at a Netspend Reload. Network Location. Up to $ Per load. Fee Issue Card Packs that allow you to immediately provide new employees. Reload Nationwide. Add money easily at a retailer near you1. Stop by one of over ,+ convenient Reload Locations nationwide to add cash in person. NetSpend Reload Pack. Iyakokin ciniki: - USD. Wuri: Amurka. Sharuɗɗan ciniki tare da pahaihua. ✓ Available for in-person & online BTC TRADING. i work for the netspend Company and whatever you load on a netspend reload pack card from, walgreens or cvs, or I can add a zero say if you put $ Use of the Card Account is subject to activation, ID verification and funds availability. Transaction fees, terms, and conditions apply to the use and reloading. Buy USD Coin with Netspend Reload Pack. Buy BTC, ETH, USDC, USDT, DAI and more cryptos worldwide using + payment methods. to a NetSpend account/card? All related (35). Recommended. Profile photo for Assistant. Assistant. Bot. ·. Jul Upvote ·. Netspend is a blackhawk product as is reloadit. They can and will track you end to end. Do not expect it to be easy. Want to reload your Money Network® Card with cash? Purchase a Reloadit pack to add to your Reloadit Safe. View this page for instructions and contact. Cash Reload at a Netspend Reload. Network Location. Up to $ Per load. Fee Issue Card Packs that allow you to immediately provide new employees. Reload Nationwide. Add money easily at a retailer near you1. Stop by one of over ,+ convenient Reload Locations nationwide to add cash in person. NetSpend Reload Pack. Iyakokin ciniki: - USD. Wuri: Amurka. Sharuɗɗan ciniki tare da pahaihua. ✓ Available for in-person & online BTC TRADING. i work for the netspend Company and whatever you load on a netspend reload pack card from, walgreens or cvs, or I can add a zero say if you put $ Use of the Card Account is subject to activation, ID verification and funds availability. Transaction fees, terms, and conditions apply to the use and reloading. Buy USD Coin with Netspend Reload Pack. Buy BTC, ETH, USDC, USDT, DAI and more cryptos worldwide using + payment methods. to a NetSpend account/card? All related (35). Recommended. Profile photo for Assistant. Assistant. Bot. ·. Jul Upvote ·. Netspend is a blackhawk product as is reloadit. They can and will track you end to end. Do not expect it to be easy.

Apply Reload to Prepaid Card. Enter Vanilla Reload PIN: Reload PIN 10 digit number listed on your receipt. NOTE: Do not buy RELOAD NetSpend VISA or MASTERCARD, not will be accepted! How do I use a Reload Pack? Page 1 of 2. 6/17/ mhtml:http. I purchased a reload pack for this company's prepaid debit card by mistake last week, and decided to order a card because I was given the option to either do so. NetSpend Reload Pack. Iyakokin ciniki: - USD. Wuri: Amurka. Sharuɗɗan ciniki tare da pahaihua. ✓ Available for in-person & online BTC TRADING. Netspend reloadable prepaid Visa cards and Mastercard and Netspend debit account with high yield savings. Plus, a reload network of over locations. There are more than , convenient locations in the U.S. where you can load money to your Brink's Money Prepaid Card Account using the Netspend Reload. There are more than , convenient locations in the U.S. where you can load money to your Brink's Money Prepaid Card Account using the Netspend Reload. With Western Union, it is easy to reload your prepaid card and mobile phone at agent locations across the US NETSPEND; NEXSCARD MNB; PARA SIEMPRE VISA CARD. Other ways of depositing cash. How do I reload a prepaid card with cash at the register? How do I load cash to my PayPal account? Reload the card at a retail location or bank using cash. Purchase a reload pack to add a predetermined amount of money to your card. Do prepaid cards build. Reload Nationwide · Purchase Cushion · Account Security · Fee Overview. Better Credit. Coming Soon. Partners. Real Madrid Prepaid Card · Austin FC Prepaid Card. Founder at Reload Packs (–present). · 5y. Related. Can I go to a To find a Netspend reload center and other stores that provide debit card. Make transfers3 from your account with PayPal to your PayPal Prepaid Card Account. You can also add money at more than , Netspend Reload Network locations. Reload Location. Load Cash or Checks Add cash at any of more than , NetSpend Reload Network locations. (Fee may apply, check with the location.) Find. See ccspoilgamestation.ru or card pack mailer for details. Just go to any of the , locations in the Netspend Reload Network and load the cash to your Small. Load these cards with Reloadit! NetSpend. PayPal. NetSpend - Western Union The Reloadit® Pack is issued by Blackhawk Network California, Inc and powered by. I purchased a reload pack for this company's prepaid debit card by mistake last week, and decided to order a card because I was given the option to either do so. Remember you should never pay anyone using any reload pack such as Reloadit, MoneyPak, Netspend Reload Pack or PayPal Cash. If someone ask you to pay. Easily move funds from another financial institution to your Netspend account. Add money at a retailer near you2. Add cash at one of over ,+ Reload. Glad to get all my money back, including the fund of which was still in the reload pack when account was closed. They also calculate some interest based on.

Taking Out My 401k

Before you start taking distributions from multiple retirement plans, it's important to note the (k) withdrawal rules for those 55 and older apply only to. If I take out withdrawals from my (k) after age 59 1/2, are those distributions taxed as income? Your age does not matter. A distribution from a k is. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. There are. Overall, when possible, you should not withdraw funds from your (k) until you reach retirement age. If you are under age 59½ at the time you take a withdrawal, you may be subject to a 10% federal tax penalty for early withdrawal. This tax penalty is in. Early withdrawals from a (k) often incur a 10% early withdrawal penalty if you're under 59 1/2. · Certain situations, like reaching age 55, leaving a job. Key Takeaways · (k) withdrawal rules affect when account holders can take withdrawals without penalty. · If you retire after age 59½, you can start taking. The IRS levies a 10% penalty on all non-exempt withdrawals before the age of 59 ½. · Since pre-taxed money funded your k account, your withdrawal is taxed. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. Before you start taking distributions from multiple retirement plans, it's important to note the (k) withdrawal rules for those 55 and older apply only to. If I take out withdrawals from my (k) after age 59 1/2, are those distributions taxed as income? Your age does not matter. A distribution from a k is. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. There are. Overall, when possible, you should not withdraw funds from your (k) until you reach retirement age. If you are under age 59½ at the time you take a withdrawal, you may be subject to a 10% federal tax penalty for early withdrawal. This tax penalty is in. Early withdrawals from a (k) often incur a 10% early withdrawal penalty if you're under 59 1/2. · Certain situations, like reaching age 55, leaving a job. Key Takeaways · (k) withdrawal rules affect when account holders can take withdrawals without penalty. · If you retire after age 59½, you can start taking. The IRS levies a 10% penalty on all non-exempt withdrawals before the age of 59 ½. · Since pre-taxed money funded your k account, your withdrawal is taxed. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income.

The IRS charges a 20% tax withholding and a 10% penalty for early withdrawals. Plus, if you spend the money in your (k), it's no longer there for you in. Withdrawals taken from your (k) account if you are age 59½ or older will not have a penalty. However, a 20% tax on your withdrawal will be withheld if the. Hardship withdrawals are another option for taking money out of a (k). Again, they are an optional plan feature that your employer might or might not make. While IRAs offer an exception to the early withdrawal penalty for college expenses, early k withdrawals are always subject to a 10% penalty—no exceptions. Key Takeaways · A hardship withdrawal from a (k) retirement account is for large, unexpected expenses. · Unlike a (k) loan, the funds need not be repaid. · A. The Internal Revenue Service allows a (k) hardship withdrawal if you have an "immediate and heavy financial need." In these situations, the 10% penalty could. The new coronavirus stimulus package will allow Americans to withdraw from their (k), penalty-free. Here's why you shouldn't do so to pay off credit card. Typically, with (k) plans, (b) plans, and individual retirement accounts (IRAs), you can start to make penalty-free withdrawals when you turn 59 ½. If you. When withdrawing your retirement savings from a (k), you can decide to take a lump-sum distribution, take a periodic distribution (either monthly or. (k) hardship withdrawals are taxable, and you can't put the money back into your account. There may also be a 10% penalty if you're making the withdrawal. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Many (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Withdrawals and distributions from (k) accounts are highly regulated, designed to discourage savers from trying to tap into their retirement savings early. Can I withdraw money from my IRA early without penalty? Learn how you may avoid the 10% early withdrawal penalty when taking money from your retirement account. Typically, with (k) plans, (b) plans, and individual retirement accounts (IRAs), you can start to make penalty-free withdrawals when you turn 59 ½. If you. However, when you take an early withdrawal from a (k), you could lose a significant portion of your retirement money right from the start. Income taxes, a If you are under 59 and a half years old, there is a tax penalty of 10% on withdrawal from k unless you qualify for an exemption. Consult you. There are other exceptions to the IRS 10% additional tax for early distribution including: your death, being disabled, eligible medical expenses, taking. There's an additional 10% penalty on early withdrawals.3 Your tax bracket is likely to decrease in retirement, which means pulling from your workplace.

Cash App Stock Investing Review

Cash App is a safe place to buy stocks. The app uses data encryption and multiple security locks to keep your account and assets safe. Users also receive push. A multi-asset strategy combines different types of assets – stocks, bonds, real estate, or cash for example – to create a more nimble and broadly diversified. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of. Want to borrow the cash or securities you need to complete a trade or short sale? Vanguard mobile app. Resources & education. Retirement · Taxes · Investing. Cash App Investing has a minimum sale amount of $1. You can sell all or some of the stock that you own. Cash App Investing allows you to purchase securities in dollar amounts rather than share quantities, allowing you to receive fractional shares. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Cash App is a safe place to buy stocks. The app uses data encryption and multiple security locks to keep your account and assets safe. Users also receive push. A multi-asset strategy combines different types of assets – stocks, bonds, real estate, or cash for example – to create a more nimble and broadly diversified. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of. Want to borrow the cash or securities you need to complete a trade or short sale? Vanguard mobile app. Resources & education. Retirement · Taxes · Investing. Cash App Investing has a minimum sale amount of $1. You can sell all or some of the stock that you own. Cash App Investing allows you to purchase securities in dollar amounts rather than share quantities, allowing you to receive fractional shares. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want.

Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Invest and save better with Betterment. Investing apps are a dime a dozen, right? So, you might be wondering why you should download this investing app. Best Cash Management Account, 1Best Investing App, 1. a landscape Stock Investing Account. Individual stocks. At risk of higher volatility. The Investor Relations website contains information about Eli Lilly and Company's business for stockholders, potential investors, and financial analysts. This article covers the basics of your Cash App Investing account and what you should know when opening your account. Robinhood is the app to have if you like a smooth interface and avoiding trading commissions, whether you're trading stocks, ETFs, options or cryptocurrency. Best Cash Management Account, 1Best Investing App, 1. a landscape Stock Investing Account. Individual stocks. At risk of higher volatility. This app is super easy for new investors or anyone who doesn't have a lot of money to invest. I did get really excited about how I was finally able to build up. A wide range of investing types. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open. Betterment can help grow your money by making saving and investing easy. Invest in a tailored portfolio, set buckets for your goals, and earn rewards. Cash App Investing allows you to purchase securities in dollar amounts rather than share quantities, allowing you to receive fractional shares. Features such as Cash Card and Boost rewards, bitcoin buying and selling, investing in stocks and ETFs, cross-border payments, Cash App Pay, and a tax. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. App store review, 10 February Star rating Ghana flag. “Chipper is a With Chipper Stocks, you can trade fractional shares of global companies. Acorns helps you save & invest. Invest spare change, bank smarter, earn bonus investments, and more! Get started. Cash App is very legit. Block has been a leader in secure peer-to-peer transactions since they first started helping smaller vendors take credit card payments. stocks, options, ETFs, mutual funds, and more. Easy-to-use tools. Powerful, intuitive platforms. Trade online, through Power E*TRADE, or with our mobile apps. This app is not only a investment app to place money but it also gives you a good insight on investing too. The app is really organized and easy to find. Stock round-ups are wonderful. They are the best thing in the world. It allows you to grow your money. Invest in Stocks, Bonds, Treasuries, Crypto, Options, ETFs, alternative assets, and music royalties with AI-powered fundamental data and custom analysis.

Cheap Stocks To Buy Now That Will Make You Rich

No they're not growth stocks imo. They're safe bets returning marginally better than Nasdaq or SPY trackers. But they won't let you down. My. Best cheap stocks · Comcast (CMCSA) · VICI Properties (VICI) · EQT (EQT) · Tapestry Inc. (TPR) · Fox (FOX, FOXA). Though these shares are usually very cheap (often trading for pennies on the dollar) they also enjoy much lower levels of oversight. If you're buying your first. Best-performing cheap stocks ; CADL. Candel Therapeutics Inc. % ; APLT. Applied Therapeutics Inc. % ; GTHX. G1 Therapeutics Inc. % ; SERA. Sera. Get full access to our VIP Newsletter right now, for FREE. Click Here. Will cheap stocks make you rich, or destroy your portfolio? There's a sure bet in the. Priced at or below INR 10, these stocks are accessible and affordable for a broad range of investors, allowing them to buy a significant number of shares at a. Investors can buy income streams and lever them up with cheap debt, and can They do face an issue of rather low switching costs between pharmacies. TOP FIVE STOCKS THAT CAN MAKE YOU RICH · Tata Consultancy services · Infosys Ltd · Hindustan Unilever Ltd · Reliance Industries Ltd · HDFC Bank Ltd. In addition, you may love the idea that penny stocks' low cost of entry allows you to buy a large number of shares, further increasing their potential reward. No they're not growth stocks imo. They're safe bets returning marginally better than Nasdaq or SPY trackers. But they won't let you down. My. Best cheap stocks · Comcast (CMCSA) · VICI Properties (VICI) · EQT (EQT) · Tapestry Inc. (TPR) · Fox (FOX, FOXA). Though these shares are usually very cheap (often trading for pennies on the dollar) they also enjoy much lower levels of oversight. If you're buying your first. Best-performing cheap stocks ; CADL. Candel Therapeutics Inc. % ; APLT. Applied Therapeutics Inc. % ; GTHX. G1 Therapeutics Inc. % ; SERA. Sera. Get full access to our VIP Newsletter right now, for FREE. Click Here. Will cheap stocks make you rich, or destroy your portfolio? There's a sure bet in the. Priced at or below INR 10, these stocks are accessible and affordable for a broad range of investors, allowing them to buy a significant number of shares at a. Investors can buy income streams and lever them up with cheap debt, and can They do face an issue of rather low switching costs between pharmacies. TOP FIVE STOCKS THAT CAN MAKE YOU RICH · Tata Consultancy services · Infosys Ltd · Hindustan Unilever Ltd · Reliance Industries Ltd · HDFC Bank Ltd. In addition, you may love the idea that penny stocks' low cost of entry allows you to buy a large number of shares, further increasing their potential reward.

Eventually it'll be cheaper to recycle than mine. And these companies have literal dump trucks of free materials that we pay them to take. They. Also, you may want to consider the best cheap stocks right now. And if you're new to investing, we can teach you how to buy your first stocks. There's lots of. Investors can buy income streams and lever them up with cheap debt, and can They do face an issue of rather low switching costs between pharmacies. Though these shares are usually very cheap (often trading for pennies on the dollar) they also enjoy much lower levels of oversight. If you're buying your first. Yes, these are often the best cheap stock to buy even if they're called “penny stocks”. When you do your research, a term like penny stock shouldn't scare you. While these stocks are affordable, they often come with higher volatility and require different strategies from those used for larger, more established stocks. 9 Best Cheap Stocks to Buy Under $5 · Ambev SA (ticker: ABEV) · Enel Chile SA (ENIC) · Sibanye Stillwater Ltd. (SBSW) · Agilon Health Inc. (AGL) · Olaplex Holdings. Stocks That Would Have Made You Rich Today · Sleep Number Corp. (SNBR) · Ulta Beauty, Inc. (ULTA) · Fonar Corp. (FONR) · Patrick Industries, Inc. (PATK) · Texas. Deep Dive · 1. Apple Inc. (NASDAQ: AAPL) · 2. NVIDIA Inc. (NASDAQ: NVDA) · 3. Shopify Inc. (NYSE: SHOP) · 4. Visa Inc. (NYSE: V) · 5. Bank of America Corp. (NYSE. 20 years from now, when your children are adults, how do you think they will view today's stock market selloff? them on the cheap (although I still feel. Top Penny Stock Gainers ; AEHL. Antelope Enterprise Holdings ; GLATF. Global Atomic ; IVVD. Invivyd ; FBRX. Forte Biosciences. Get full access to our VIP Newsletter right now, for FREE. Click Here. Will cheap stocks make you rich, or destroy your portfolio? There's a sure bet in the. And here are some of the disadvantages of trading penny stocks: While a penny stock might be cheaper than many other shares on the market, cheap doesn't mean. Still, the potential to make large returns is a strong allure, driving risk-taking investors into taking positions in these securities. Though many penny stocks. Tempting day traders with the prospect of significant financial gains and a low cost of entry. Stories of stocks gaining of over 5,% in just a short time add. Rich people spend to INVEST. Buying and selling. Buying something cheap on EBay and sell at a profit. I have heard of people buying houses on Ebay from trading. My goal is to invest for long-term returns, not looking at all to make money now. But want to find 10 penny stocks that are the best opportunities to "get. If you only have a few hundred dollars or you want to trade in round lots instead of a single share, then cheap stocks – or at least cheaper stocks – are one. Cheap Price – The most notable advantage of penny stocks is the low cost of purchase. A trader can buy a large number of shares even with a small amount of. Best Stock Market Quotes. 5. "It's not whether you're right or wrong that's important, but how much money you make when you're right and.